South Africa is expected to import coal from Botswana in the near future as its own reserves deplete — a move that will increase demand for the proposed Mmamabula–Lephalale Railway, which aims to transport cargo between the two countries.

The railway is planned to link the Mmamabula coalfields in Botswana with Lephalale in South Africa, enhancing regional trade and infrastructure.

Speaking at an investors' conference on the project hosted by Botswana Railways, Dr Maximilian Matschke, a strategy consultant and managing partner at Anura Partners, stressed the importance of the railway for South Africa’s energy security. He noted that Eskom, South Africa’s power utility, is running out of coal, particularly in the Mpumalanga region, and will in the future need to import coal — with Botswana being the most logical source. Coal contributes 77% of South Africa’s energy. Matschke said the total shortfall at current plans is 650 to 700 metric tonnes.

Matschke explained that the quantities involved would make road transport uneconomical, further underscoring the need for a dedicated rail line. While the primary purpose of the Mmamabula–Lephalale Railway is to move coal and other goods from Botswana to South Africa, he pointed out that the line could also facilitate petroleum imports into Botswana, reducing the country's fuel landing costs. Currently, Botswana imports petroleum via road tankers from South Africa.

He noted that the project stands out among regional initiatives because it already has committed freight, which enhances its viability. The estimated economic impact of the railway is around US$160 billion, according to Matschke. He added that there is significant interest from potential funders, especially because the project is not a ‘pure corridor’ but a commercially viable venture with strategic importance.

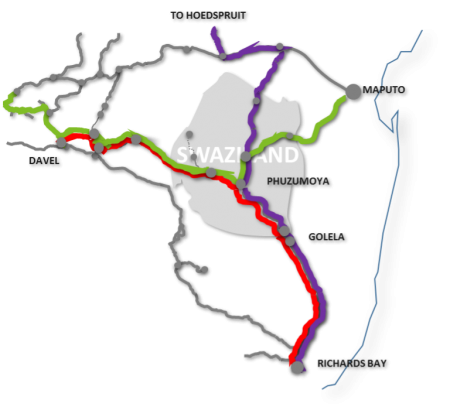

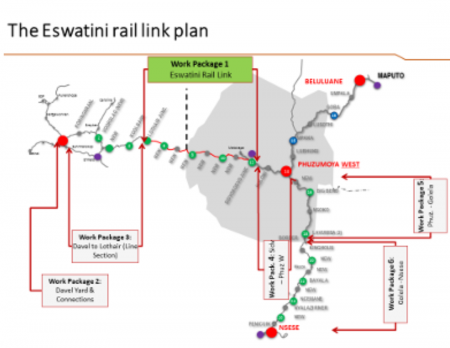

He also mentioned that proposed upgrades to the rail network between Ermelo and Richards Bay would position the project as a Southern African Development Community (SADC) cross-border initiative, a category that typically attracts funding from development banks.

Addressing investor concerns, Matschke cited Botswana’s current restriction on foreign companies operating its railways, in contrast to South Africa, which has recently opened its Transnet-owned lines to private operators. He outlined several models under consideration for the project’s operation and investment recovery, including a public partnership between Botswana Railways and Transnet, a concession model, a special purpose vehicle (SPV), or an open-access arrangement allowing both public and private participation.

While there have been suggestions to link the project to Eswatini for access to Richards Bay or Maputo, thereby avoiding South Africa’s congested coal lines, Matschke maintained that the Mmamabula–Lephalale Railway, in its current form, remains the most cost-effective option for Botswana. He also noted that Eswatini’s railway infrastructure would require significant upgrades to accommodate 200-wagon trains and heavier 26-axle loads.

Beyond coal, the railway is also expected to transport chrome, soda ash, iron ore, copper, and petroleum, further boosting its economic and strategic significance.

Written by Chamwe Kaira