This content is for Premium Subscribers only. To view this content, login below or subscribe as a Premium Subscriber.

Related News Articles

2 min

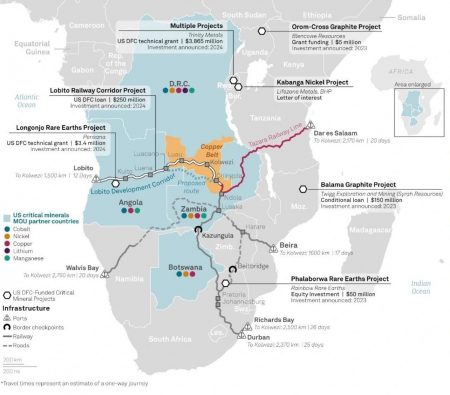

Lobito, TAZARA Threaten Walvis Bay’s Attractiveness to Namibia’s Neighbours

01 March 2025

SADC, Zambia

2 min

Traxtion Expands Operations into Angola with New Contract

02 February 2025

SADC, Angola

1 min

SADC Secretariat Convenes Lobito Corridor Committee of Ministers to Launch Interim Secretariat

02 February 2025

SADC, Zambia

3 min

The Lobito Corridor is Now a Top Priority for the US and Angola

07 December 2024

SADC, Angola

1 min

AFC-led Zambia Lobito Rail Project Receives Boost from Biden's Visit to Angola

07 December 2024

SADC, Zambia

3 min

Angola and the USA Sign $1 Million Agreement to Strengthen National Infrastructure

07 December 2024

SADC, Angola

1 min

Lobito Atlantic Railway Reinforces Transport Capacity with New Wagons

14 November 2024

SADC, Angola

1 min

AFC Hoping For Financial Close For Zambia-Lobito Rail Project Within Two Years

30 October 2024

SADC, Zambia

2 min

DBSA Approves $200 Million For The Lobito Corridor Railway Project

07 September 2024

SADC, Angola

2 min

Lobito Atlantic Railway Begins Exporting Copper from the DRC to the United States

26 August 2024

SADC, Angola

1 min