This content is for Premium Subscribers only. To view this content, login below or subscribe as a Premium Subscriber.

Related News Articles

Zambia: Suspension of Passenger Train Services Following a Goods Train Derailment

22 April 2025

SADC, Zambia

1 min

1 min

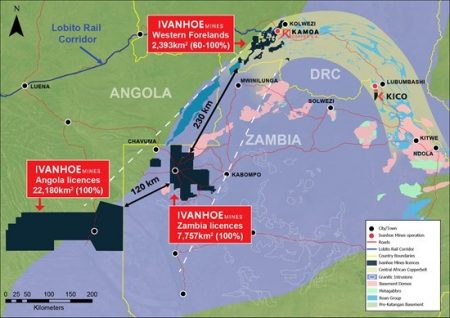

Zambia and Angola Sign Landmark Agreement to Advance Lobito–Zambia Railway Project

14 April 2025

SADC, Zambia

1 min

Stanbic Ready to Support Transport and Logistics Sector

14 April 2025

SADC, Zambia

3 min

6 min

European Union Pledges Continued Support to Zambia

05 April 2025

SADC, Zambia

1 min

2 min

2 min

1 min

Egypt, Turkey, and France Ambassadors Accredited to COMESA

20 February 2025

SADC, Zambia

2 min

Zambia Railways Key in Zambia’s 3 Million Tonnes Copper Production Target

14 February 2025

SADC, Zambia

1 min

Zambia Government Welcomes DP World for Partnership

14 February 2025

SADC, Zambia

1 min

Closure Of Ndola-Sakania Railway Line Due to Sinkhole Incident

14 February 2025

SADC, Zambia

1 min

Lobito Corridor Key to Zambia’s Economic Transformation

06 February 2025

SADC, Zambia

1 min

IDC Zambia Calls for Urgent Railway Sector Reforms

06 February 2025

SADC, Zambia

1 min

SADC Secretariat Convenes Lobito Corridor Committee of Ministers to Launch Interim Secretariat

02 February 2025

SADC, Zambia

3 min

Zambia Reaffirms Its Commitment Towards the Operationalisation of the Lobito Corridor

24 January 2025

SADC, Zambia

2 min