This content is for Premium Subscribers only. To view this content, login below or subscribe as a Premium Subscriber.

Related News Articles

Transnet Sustains Improved Performance to Set the Path for Growth

18 December 2025

SADC, South Africa

2 min

South Africa’s Largest Private Rail Investment Begins with Forty-Six Locomotives

12 December 2025

SADC, South Africa

1 min

Transnet and ICTSI Seal Partnership for DCT Pier 2

10 December 2025

SADC, South Africa

1 min

Traxtion Confirms R3.4bn Rolling Stock Investment to Unlock Rail Capacity and Jobs

05 December 2025

SADC, South Africa

4 min

Transnet Opens Registration of Interest for Northern Cape Iron Ore Export Capacity

05 December 2025

SADC, South Africa

1 min

EIT Group’s Estcourt Intermodal Freight Village Due for Expansion

05 December 2025

SADC, South Africa

3 min

South Africa: TRIM Opens Submissions for Ad-hoc Train Path Applications

05 December 2025

SADC, South Africa

1 min

UNTU Condemns PRASA’s Section 189A Restructuring and warns of Over 500 Job Losses

28 November 2025

SADC, South Africa

1 min

Durban–Gauteng Logistics Corridor to Receive Major Boost from Private Investors

21 November 2025

SADC, South Africa

4 min

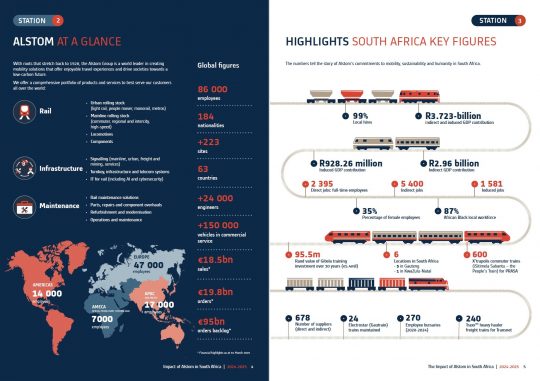

Alstom Impact Report Reaffirms Deep Commitment to South Africa

21 November 2025

SADC, South Africa

3 min

Advancing Urban Mobility: SAICE’s Perspective on Integrated Public Transport in SA

14 November 2025

SADC, South Africa

5 min

Traxtion – Still on Track, Still Driven, 38 Years of Excellence

14 November 2025

SADC, South Africa

3 min

Lucchini South Africa Benefits from National Industrial Participation Programme (NIPP)

07 November 2025

SADC, South Africa

4 min

PRASA Renewable Energy Project, Train Set 300, and Isipingo Mall

03 November 2025

SADC, South Africa

2 min